EDITORIAL: Corporate landlords are the real welfare queens

And renters and taxpayers are paying for it

I had a great holiday break and am thankful as a dumpster diving enthusiast for the opportunity to enjoy the many fruits (or discarded fruit cakes to be specific) of my labor. It’s a shame to see so many perfectly good loaves of bread to go to waste in those big dumpsters behind stores while inside the stores I see people scrounging together as many coupons and/or food stamps as they can get.

It seems the tax and grocery bills get bigger each day and the paychecks from the boss and the government get smaller. Most people have accepted keeping their heads just above the water as the new American Dream. However, one of the most persistent arguments against asking taxpayers to pay for a new welfare program is that the end-users will abuse the system and waste it.

The welfare queen myth

The welfare queen, as the myth goes, is going to trade her food stamps for a Cadillac. The lazy college student is getting a useless liberal barista degree so they can pay their own tuition, and everyone with stimmy checks during Covid just wasted them on Steam games and DoorDash.

The prevailing narrative for those in favor of ruthless austerity and welfare-slashing has been that ordinary, average tax-paying citizens can’t be trusted with their own government’s money. Corporations, however, get a different set of rules to play by. Can’t they be trusted with the public purse if they have a professional looking website and logo?

These conversations about profiting from taxpayers are not had when for-profit corporations meet with government officials to receive lucrative public land leases, contracts, patents, tax breaks, bailout packages, special access to credit and capital. These are only a few of the many other avenues for the phenomenon known as corporate welfare to exist, or “socialism for the rich” as some others have called it.

Whether this misconception comes from racism or class conflict is now besides the point. The pressing issue is identifying the actual modern-day economic monarchs who get money for nothing, and depending on if they are Dire Straits, chicks for free.

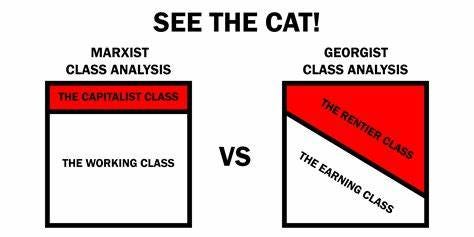

The real culprit: the rentier class

Certain kinds of corporations regularly siphon off enormous amounts of publicly-created wealth, leaving the government to tighten its belt for truly needed public programs. The welfare queen myth remains a convenient scapegoat for the real aristocracy of institutional investor-landlords.

While the significance of a landed aristocracy may seem to be a thing of the agrarian past, land ownership remains one of the most important economic issues to this day and is the reason why real estate markets underpin the health of the entire economy. The worst offenders today are the corporate and absentee landlords who are responsible for the 16 million vacant homes while nearly six hundred-thousand Americans sleep on the streets.

I am talking about a group of people economist Michael Hudson refers to as “the rentier class.” Pronounced “ront-ee-ay,” it is a name so French and so fancy it makes the bourgeois sound like the proletariat.

The rentier class operates in several areas of the economy. Their original and primary asset comes in owning the nation’s land, but the rentier class owns many kinds of natural resources and financial assets like debt. They are represented by what is known as the FIRE industries (Finance, Insurance and Real Estate). Corporate absentee landlords are often one in the same as financial institutions and banks.

There is a difference between the faceless rentier corporation and the property developers and managers you actually see in person. The caring property manager or owner who lives side by side with their tenants fixing leaky faucets and mowing the lawn should not be thrown under the bus. They create value by providing amenities.

The rentiers, however, like to run things from a distance, and paying for amenities for tenants are their worst nightmares. The executives and shareholders at firms like StateStreet, Vanguard and BlackRock won’t be hosting any sleepovers at one of their millions of empty single-family homes anytime soon. Trust me, I asked.

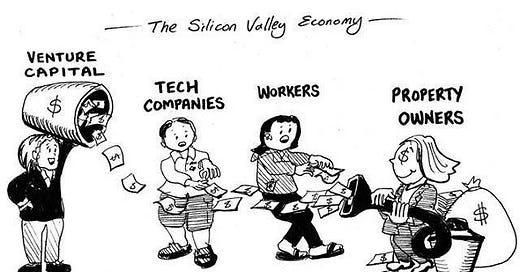

How the rentier class affects the economy

The rentier class affects the economy through two main ways simultaneously:

Firstly in the private sector, the rentiers drive up production costs by charging rents, royalties, fees and interest for businesses to even operate in the market. Businesses require the same land and natural resources their competitors use, however it’s the corporate landlords and rentiers who get to plan the winners and losers of industry while producing no goods or services themselves.

Secondly in the public sector, corporate landlords and rentiers charge working families rent and high interest for housing. The consequences of rentierism (unemployment, low wages, inflation, housing insecurity) creates a mass of working poor people needing every kind of public service imaginable. The cost of this man-made poverty is of course passed on to the average taxpayers if the government decides to help.

The rentier class collects rent from monopolies on everything from land and natural resources, to credit and interest, to intellectual property and royalties. In the productive economy, businesses and workers both make money by contributing resources (time, energy, money, labor etc.) to society. The rentiers of the finance, insurance and real estate monopolies on the other hand get paid for withholding resources from the rest of the society.

Progress, poverty, and polarization

The confusion in the economic world has led to confusion in the political world. Everyone sees the same issues of rising poverty with economic growth, but the two sides of the aisle have each put up scapegoats to cover up for the rent-seekers who influence the policymaking process.

Both labor and capital, with access to the resources of the land make the economy work, but landlords have successfully made those on the left blame job creators and employers for poverty and those on the right have made working class welfare-users the primary suspect.

The rent money accumulates in the coffers of banks, insurance companies and corporate landlord firms.

While property developers gain profit by cost-cutting to increase profits, rentiers gain profit by charging rent and raising costs. As land, credit, insurance and intellectual property are vital detrimental to the survival of businesses and households, the rentier class has their hands on the levers of the economy and by extension the society.

End the monopolies and establish the land-value tax

Without the private Finance, Insurance and Real Estate sectors extracting money (rent-seeking) from the productive economy, we would have a large enough pool of available public funds to improve infrastructure, support the unemployed, pay for adequate public healthcare and a number of other things all that other stuff obviously bullcrap nobody wants that FDR and MLK called for in their own proposed economic bills of rights.

This disjointed and parasitic relationship created and sustained by the financial and landlord monopolies could be undone with a relatively simple policy. If taxes are placed on the unimproved value of land and natural monopolies where the corporate landlords draw the base of their wealth from, while taxes on production and wages are reduced or abolished, then the government can be funded, and working people in the free market can keep more of their earnings.

The renowned libertarian economist Milton Friedman called it the “least bad tax” (which means a lot if you knew who Friedman was) and environmental activist Ralph Nader pushed for people “to talk about how corporations are freeloading on public services and getting tax breaks while taxes are falling on workers and smaller businesses,” and how there is a need “to open a debate about land taxation and Henry George.”

This means that the wealth created by nature would fund the community as a whole, and the wealth created by private individuals would be left for them to keep. Establishing a land value tax this way is like putting Mother Earth in charge of the Treasury Department. She can fund the government much better than Janet Yellen or Jerome Powell ever can.

This article appeared in The Indiana Commons.